- Business Center

- TEA Correspondence

- Independent School Districts

TEA Correspondence Information

Page Navigation

June 23, 2023

Posted by Business Center on 6/23/2023

- Tax Year 2023 Maximum Compressed Tax Rates (MCR)

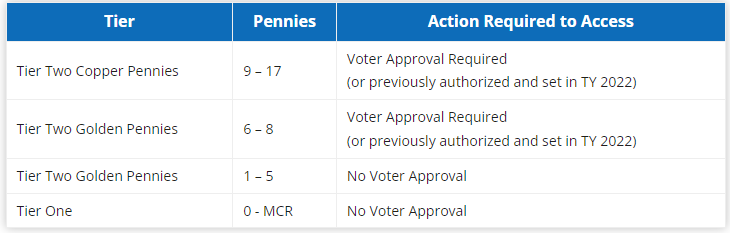

As expected, TEA has released the official MCR numbers for the 2023 tax year (2023-2024 fiscal year) at $0.7950. In accordance with TEC, §48.2552(c), and after accounting for additional state revenue determined under TEC, §48.2552(b), the maximum state compression rate for TY 2023 was also reduced by an additional 8.25 pennies in the 2023 year only (under current law).

TY 2023 State MCR: 0.8941 × (1.025 ÷ 1.0443) - 0.0825 = $0.7950*

In order to maintain tax rate equity, no district may have an MCR less than 90 percent of any other district. The limit on local compression for TY2023 will be $0.7155 ($0.7950 * 0.90).

*The current MCR does not supersede any items in the TTC, TEC, or TAC laws. If potential Legislative action changes any of these laws, additional guidance will be sent out and updated. Until then, please make sure to follow current law in planning for your tax rate calculations.

Additional information on these calculations can be found in the TAA letter sent out on June 22nd.

- Tax Rate Compression Calculations

TEA has yet to release the updated MCR template (as of this morning) to assist in the calculation of the items above. Until they release their official template, you can utilize the previous year’s version and update all of the data in formulas accordingly. If you need assistance with this process, please let me know.

As a reminder, the maximum M&O tax rate for any district in TY 2023 will be $0.9650 = $0.7950 + $0.17. Districts with local compression that exceeds state compression will have a lower maximum M&O tax rate.

When TEA releases the updated MCR template, it will be posted on the State Funding page under the District and Charter Planning Tools section.

- Instructional Materials and Technology Allotment

The 2024‒2025 biennium instructional materials and technology allotment allocations for each district and open-enrollment charter school (local educational agency or LEA) will be available on the instructional materials website and are expected to be populated in EMAT, the state’s online ordering system, by mid-July, 2023.

Although the amounts will appear soon in EMAT, the actual funds will not be available until after September 1, 2023. Until that time, LEAs may use unexpended funds (carry-over funds) for allotment expenditures, including newly adopted instructional materials, continuing contracts, technological equipment, and technology services.

House Bill 1605 (88th Regular Texas Legislature, 2023) establishes two new Foundation School Program (FSP) entitlements for SBOE-approved instructional materials, in addition to this Instructional Materials and Technology Allotment allocation. Those entitlements are not part of this per student allocation amount and will be provided in addition to these amounts. More details on those entitlements will follow in a future TAA.

Additional information can be found in the TAA letter sent out on June 22nd.